Unsure of the benefits you are enrolled in or what it is costing you?

Check your Benefits Summary in your RCUH Employee Self-Service to see all of the employee benefits you are enrolled in, who is paying for it (employee or employer), and how much is being deducted from your paychecks!

To access your Benefits Summary: Log in to your RCUH Employee Self-Service > under Employee Information click on Employee Benefits – See Benefits Summary. Please note the Benefits Summary currently is only for regular-status benefits-eligible employees who are 50%-100% FTE.

Helpful Tip! You should check your Benefits Summary periodically to check if rates have changed, if your employment status affected any benefits (i.e., FTE reduction), etc. It is best to stay informed of your benefits, especially those that you pay for so there are no surprises in the future.

Benefits that you were previously enrolled in but are no longer actively enrolled in may still appear in your Benefits Summary. However, those benefits should say “Waived.”

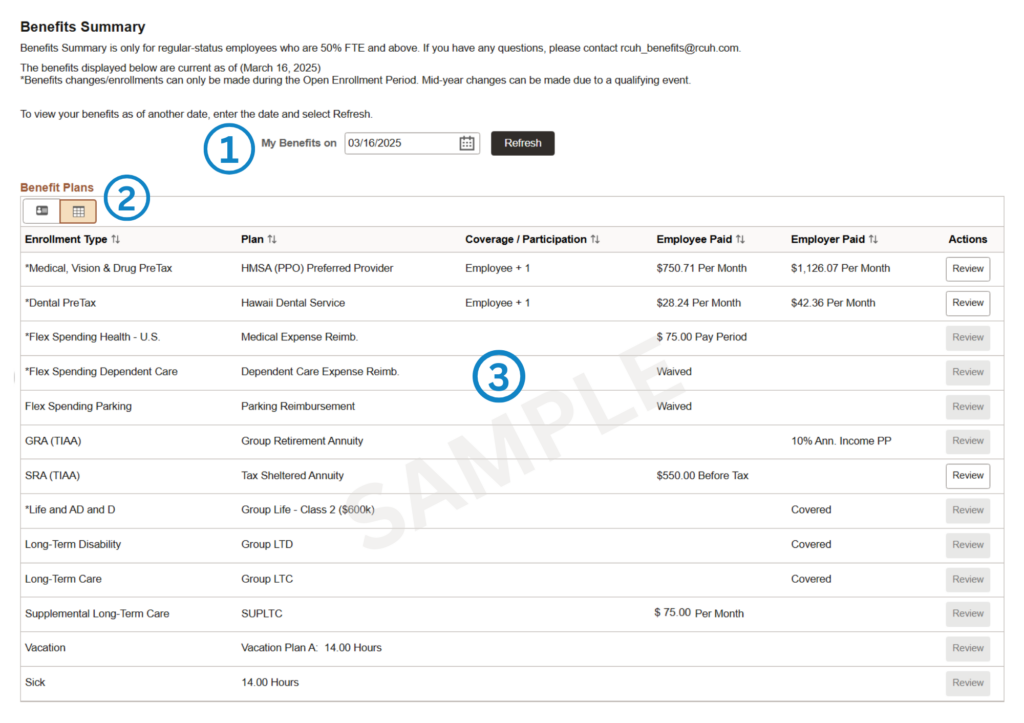

1. View Your Benefits as of Another Date

The date will default to the 1st of the current pay period. If your benefits coverage begins at a later date, you can select a future date to see your benefits information. Change the date and click on "Refresh." Please note the sick and vacation leave balances will not change and will only show your balances as of today's date.

2. Change Your Benefit Plans View

You can toggle between the two icons to view your Benefit Plans either as tiles or as a list.

3. Benefits Information

- Enrollment Type: Type of Benefit that you are enrolled/waived in

- Plan: Depending on the benefit, this section will either list the provider or the benefit code as it will appear on your pay statement.

- Coverage/Participation: Coverage tier you are enrolled in (if applicable)

- Employee Paid: How much is being deducted from your pay statement or how much you are contributing and frequency. If you see "PP," this mean per "Pay Period."

- Employer Paid: How much the employer is paying. Please note this amount is not being deducted from your pay statement.

Medical, Vision & Drug PreTax/PostTax

Medical plan that you are enrolled in and how much is being deducted per month. This section will show if you are enrolled in medical insurance on a pre-taxed or post-tax basis.

If you are waived, it will say “Waived.”

Please note if you added a domestic partner to your medical plan this will be listed separately.

Dental PreTax/PostTax

If you are enrolled in dental and how much is being deducted per month. This section will show if you are enrolled in dental on a pre-taxed or post-tax basis.

If you are waived, it will say “Waived.”

Please note if you added a domestic partner to your dental plan this will be listed separately.

Flex Spending Health - U.S.

If you are enrolled in the FSA Healthcare and how much you are contributing per pay period. Plan year ends on June 30th.

Flex Spending Dependent Care

If you are enrolled in the FSA Dependent Care (i.e., childcare or day care expenses) and how much you are contributing per pay period. Plan year ends on June 30th.

Flex Spending Parking

If you are enrolled in the Pre-Tax Parking and how much you are contributing per month.

Flex Spending Transit

If you are enrolled in the PreTax Bus Pass and how much you are contributing per month.

GRA (TIAA)

If you are eligible for the Group Retirement Account (GRA) 401(a). Once eligible, the employer contributes 10% of your base pay per pay period into your retirement account with TIAA. Employees may not contribute or change contribution amounts to the GRA 401(a).

SRA (TIAA)

If you are contributing to the Supplemental Retirement Account (SRA) 403(b). This retirement account is a separate account from the GRA 401(a) with TIAA. Employees may voluntarily contribute to the SRA 403(b). This shows the contribution amount per pay period. Employees may change or cancel their contributions at any time.

Life and AD and D

All eligible employees are automatically enrolled into the employer-paid Life Insurance Benefit. Actual life insurance claim payout is subject to the provider’s review and approval.

Long-Term Disability

All eligible employees are automatically enrolled into the employer-paid Long-Term Disability Benefit. Actual claims are subject to the provider’s review and approval.

Long-Term Care

All eligible employees are automatically enrolled into the employer-paid Long-Term Care Base Benefit. Actual claims are subject to the provider’s review and approval.

Supplemental Long-Term Care (SUPLTC)

If you bought above the Long-Term Care Base Benefit for yourself, the amount you are contributing monthly will appear here. Please note if you were approved to add eligible family members, the payment amount will not show up here since you will be making those payments directly to the provider.

If you were previously approved and contributing to SUPLTC and no longer see amounts here, you may no longer be eligible (i.e., no longer a Regular-status employee 75%-100% FTE).

Vacation

What vacation plan you are in and what your balance is as of today.

Sick

Your sick leave balance as of today.

Launched 4/2025