This sample pay statement is being used for informational purposes only, to help you understand which benefits are being deducted and/or contributed.

Keep in mind that not all of these may appear on your pay statement, as some deductions/contributions may not be applicable to you. Please review

the RCUH policies regarding eligibility requirements.

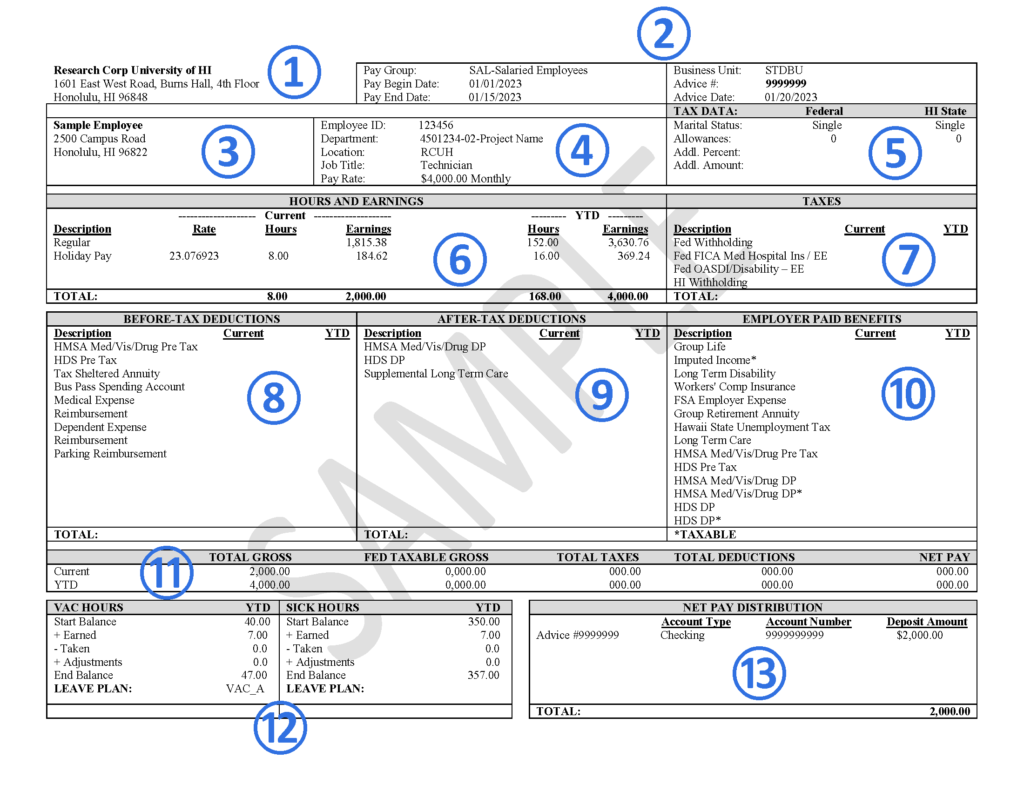

Order of Before-Tax and After-Tax Deductions (if applicable):

- Involuntary deductions (if any) – Child Support, Garnishments, Levies, etc.

- Voluntary deductions/Elected Benefits (if any) – a. Medical, b. Dental, c. Flexible Spending Account – Medical, d. Flexible Spending Account – Dependent Care,

e. Flexible Spending Account – Parking and/or Transit, f. Supplemental Long-Term Care, g. Supplemental Retirement Annuity.

Note: Deductions will be pulled based on earnings. If you do not have enough earnings, it may result in a reduced or zero dollar pay check and/or loss of coverage of benefits.

1. Employer Name and Address

- Employer name and business address.

2. Payroll Information

- Pay Group: Indicates salaried, hourly, or multiple projects (MPJ).

- Pay Begin and End Date: This is a time frame which employee time is recorded and used to calculate earned wages and determine when employees receive their pay. Also known as the pay period. The RCUH is on a semimonthly payroll (two pay periods every month) – 1st to the 15th, and the 16th to the end of the month.

- Advice #: The number assigned to your direct deposit pay. Similar to a check number.

- Advice Date: Pay day (when funds are available to you). Pay days are indicated in Green in Personnel Action & Payroll Calendar.

3. Employee Name and Address

- Employee’s name on file.

- Employee’s address on file.

4. Other Employee Information

- Employee ID: RCUH Employee ID#.

- Department: The employee’s primary department.

- Location: Project name.

- Job Title: Job title.

- Pay Rate: Salary/hourly rate.

5. Tax Data

- Marital Status: Marital status for tax withholding purposes.

- Allowances: Tax withholding allowances for Federal and State.

6. Hours and Earnings

- Broken down by Regular hours and earnings and other codes (if applicable).

7. Taxes

- The amount of mandatory taxes withheld from your current pay. This includes Federal, State, Social Security (OASDI) and Medicare taxes.

8. Before-Tax Deductions

Items listed in this box are deductions taken from your gross wages before taxes are calculated. These deductions reduce your Federal taxable wages, and therefore your tax withholding (i.e., tax savings). Current and year-to-date (YTD) amounts are listed.

9. After-Tax Deductions

Items are listed in this box are deducted from your net pay (gross wages minus taxes). Since after-tax deductions are deducted from net pay and not gross pay, they do not affect taxable income and do not affect the amount of taxes you owe. Current and year-to-date (YTD) amounts are listed.

10. Employer Paid Benefits

- This section shows the employer paid benefits amounts (paid by the project’s fringe) for statement’s pay period. Current and year-to-date (YTD) are listed.

- Items that may appear here are listed below. For more information, see the fringe benefits table. If any amounts are included as taxable income, they will be indicated with an asterisk.

- Group Life

- Imputed Income*

- Long Term Disability

- Workers’ Comp Insurance

- FSA Employer Expense

- Group Retirement Annuity

- Hawaii State Unemployment Tax

- Long Term Care

- HMSA Med/Vis/Drug Pre Tax

- HDS Pre Tax

- HMSA or Kaiser Med/Vis/Drug DP

- HMSA or Kaiser Med/Vis/Drug DP*

- HMSA or Kaiser Med/Vis/Drug After Tax

- HDS DP

- HDS DP*

11. Pay Statement Summary

- Total Gross: The total gross pay you received in the statement’s pay period.

- Fed Taxable Gross: Amount of an employee’s gross pay that the IRS deem subject to taxes.

- Total Taxes: The total of Federal and State withholdings.

- Total Deductions: The total of the before tax and after-tax deductions (after tax should have - in between).

- Net Pay: The gross pay minus deductions and tax withholdings paid to the employee.

12. Year-to-Date (YTD) Vacation Leave and Sick Leave

- Start Balance: Indicates the balance at the beginning of the year (i.e., January 1)

- +Earned: Shows hours earned (i.e., accrued) year-to-date (YTD).

- - Taken: Shows hours taken year-to-date (YTD) as of the specified pay end date. Note: leave taken might not be reflected timely if timesheets were not submitted by the payroll deadline or if a timesheet correction is pending manual processing.

- +Adjustments: Shows adjustments due to situations such as correction, or carryforward to update the end balance.

- End balance: Indicates the calculated balances at the end of the statement’s pay period.

13. Net Pay Distribution

- Shows net earnings for the statement’s pay period. If you have more than one account set up for direct deposit, each account and the amount of deposit will be shown.

- This information notes how the earnings for the statement’s pay period are paid to you.