TO: All Eligible Regular-Status Employees that wish to elect/maintain the Maximum Allowable Contribution in the Calendar Year

On October 21, 2022, the Internal Revenue Service (IRS) announced cost-of-living adjustments increasing the maximum dollar contributions for pension plans and other retirement-related plans for 2023. Effective January 1, 2023 maximum contribution limits will increase (see Table below):

Supplemental Retirement Annuity (SRA) Maximums – Effective January 1, 2023

| 2022 Maximum | New 2023 Maximum | |

| Under 50 years old | $20,500 | $22,500 |

| Additional catch-up contribution for individuals 50 years or older | $6,500 (Total $27,000) | $7,500 (Total $30,000) |

New Participants (electing maximum allowable contribution):

- Read 3.560 RCUH Retirement Plans Policy.

- First enroll in an SRA account online with TIAA at https://www.tiaa.org/rcuh, or call TIAA at (800) 842-2252.

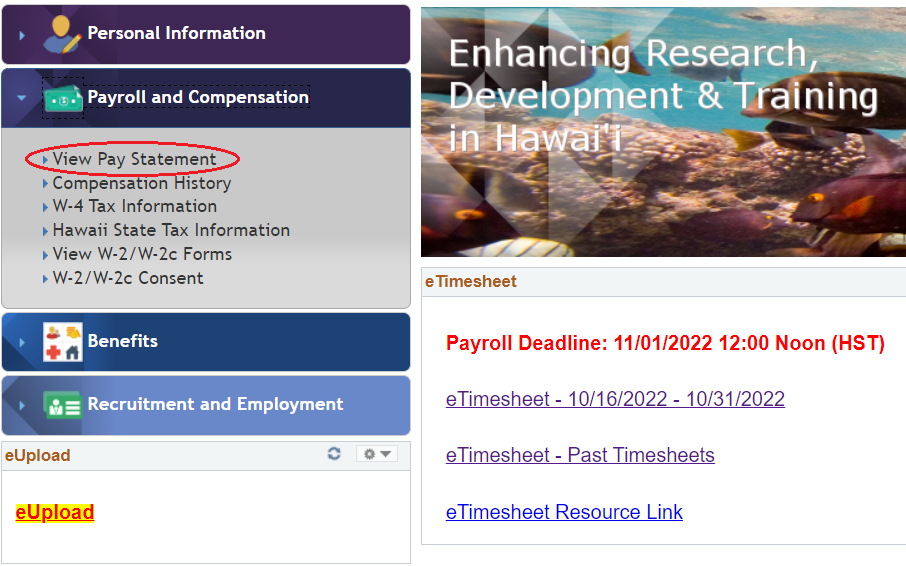

- Complete the Agreement for Salary Reduction Form (Form B-6) and submit via Employee Self-Service eUpload link no later than December 22, 2022. This will ensure contributions will begin effective December 16, 2022, which is the first pay period for the 2023 Calendar Year.

Current Participants (previously elected the maximum allowable contribution):

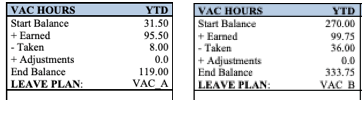

If you have previously elected the maximum allowable contribution, you must submit a new Agreement for Salary Reduction Form (B-6) if you wish to maintain the maximum allowable contribution amount for the TIAA Supplemental Retirement Annuity (SRA) plan if you have elected. The RCUH does NOT automatically adjust your SRA contributions to the revised IRS Maximums ($937.50 per pay period for individuals under 50 years old, $1,250 per pay period for individuals 50 years or older).

- Complete the Agreement for Salary Reduction Form (Form B-6) and submit via Employee Self-Service eUpload link no later than December 22, 2022. This will ensure contributions will begin effective December 16, 2022, which is the first pay period for the 2023 Calendar Year.

If you have any questions, please contact RCUH Human Resources Department’s Benefits Office via email at [email protected] or contact them at (808) 956-3100.

Relevant Links:

- IR-2022-188 (IRS Announcement)

- RCUH Policy 3.560 Retirement Plans